Can SRRV holders import a personal vehicle duty-free?

Can SRRV holders purchase health coverage from international insurance companies?

Yes. Many international health insurance providers such as Cigna, Allianz, or Pacific Cross offer comprehensive medical plans for SRRV holders residing in the Philippines. These plans cover hospitalization, outpatient services, and even emergency evacuation, ensuring retirees have global healthcare protection.

Can the SRRV deposit be used to purchase a condominium immediately?

Under the SRRV Classic program, retirees may request to convert their USD 50,000 or USD 20,000 deposit into a real estate investment after approval from the PRA. However, the property must be PRA-accredited, and the title registered under the retiree’s name to qualify.

Is it possible to apply for SRRV while living outside the Philippines?

Yes. Applicants can start the process through the nearest Philippine Embassy or Consulate. Once the basic documents are prepared and verified, the retiree may complete the remaining steps upon arrival in the Philippines. The PRA can assist in final processing locally.

Do SRRV holders need to register with the Bureau of Immigration (BI)?

No. SRRV holders are automatically registered with the Bureau of Immigration through the Philippine Retirement Authority. The SRRV ID serves as a valid ACR-I card replacement, so no separate registration or annual BI renewal is required.

What are the typical living expenses for SRRV retirees in the Philippines?

Living costs vary by location. On average, retirees can enjoy a comfortable lifestyle with USD 1,200–2,000 per month, covering housing, food, healthcare, and leisure. Cities like Cebu, Davao, and Dumaguete offer a lower cost of living compared to Metro Manila.

Can SRRV holders import a personal vehicle duty-free?

No. While SRRV members can import household goods tax-free (up to USD 7,000), vehicles are not covered by the duty-free privilege. All car imports are subject to regular customs taxes and approval by the Bureau of Customs and LTO.

What happens if my dependent gets married or turns 21?

Once a dependent child turns 21 or marries, they lose eligibility under the principal retiree’s SRRV and must either apply for their own visa or exit the Philippines. PRA should be notified in advance to update the membership record.

Can SRRV members access government discounts or privileges in the Philippines?

Some establishments and local governments offer senior citizen-style discounts or perks to SRRV holders, especially in tourism and healthcare sectors. However, these are not legally mandated and depend on individual business policies.

Is the SRRV suitable for digital nomads or remote workers?

Yes. The SRRV is ideal for digital nomads, online entrepreneurs, and retirees who work remotely, since it provides indefinite stay, no visa renewals, and a stable legal residence. Holders may work online for foreign companies without needing a local work permit.

Can SRRV retirees join local clubs or associations in the Philippines?

Absolutely. SRRV holders are welcomed in social, golf, country, and community clubs throughout the Philippines. Memberships provide great opportunities to connect with other expatriates, network, and enjoy an active social lifestyle.

★

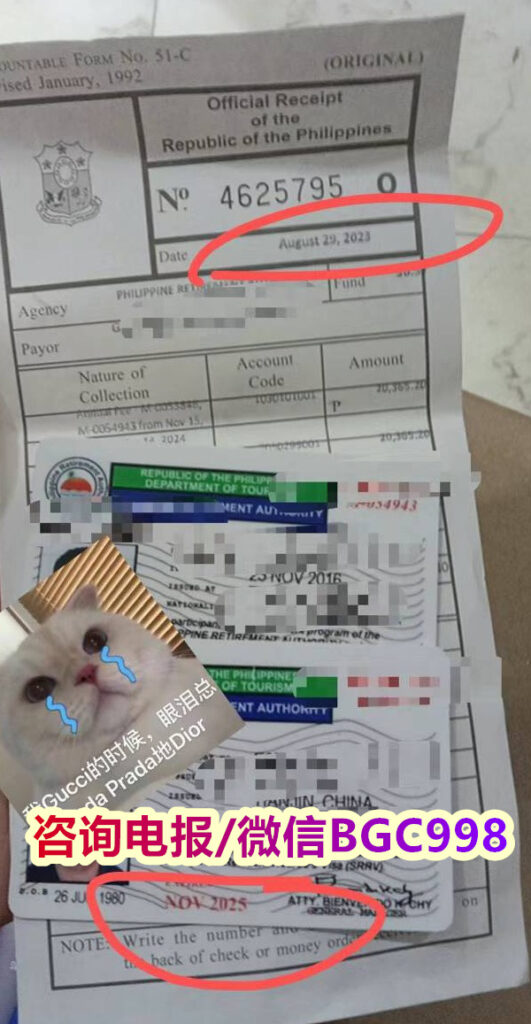

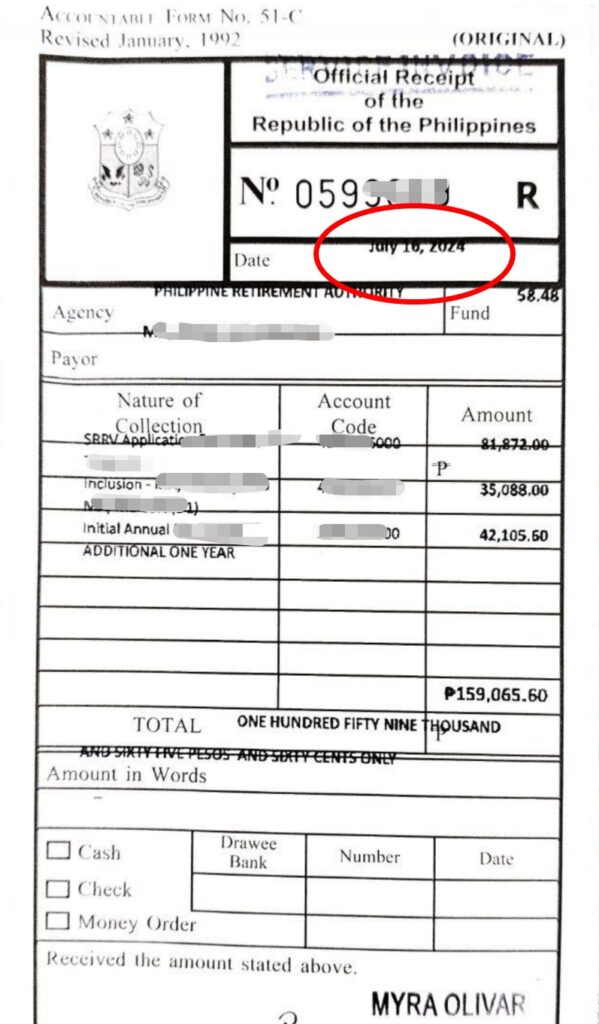

针对以上话题您是否想了解更多?欢迎联系我们咨询

English/Tagalog Inquiries :

WeChat : dpylanayon

Telegram : @Diadem_Pearl

Email : dplanayon.royalewonders@gmail.com

Viber : +63 939 526 6731 / +63 9176523432

WhatsApp / Phone : +63 9176523432

中文咨询:

微信:BGC998 电报:@BGC998

或 微信:VBW333 电报:@VBW777

菲律宾998VISA 是菲律宾 Makati 实体注册公司,拥有 超过19年本地服务经验,客户隐私安全保护、服务正规可靠。

业务资料可安排工作人员上门取件,或前往我们办公室递交。

菲律宾政策变化频繁,且官方信息发布时间存在差异,

如需了解最新移民、签证、退休项目及其他政府相关业务资讯,欢迎随时联系我们。

📢 欢迎关注我们的Telegram频道:

官方资讯频道:@FLBYM998

日常案例分享频道:@FLBYM998CASE

Post a Comment